If you’re looking for a self-directed IRA or solo 401(k) plan that will allow you to invest in alternative assets, you need to investigate Rocket Dollar.

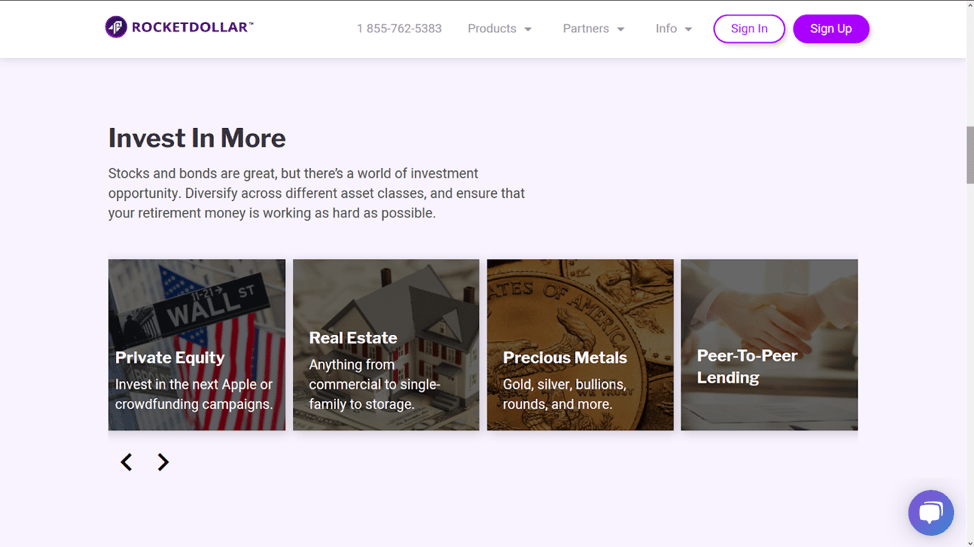

The platform has been established specifically for investors who want to hold non-traditional assets, like precious metals, cryptocurrencies, real estate, and peer-to-peer loan investments.

Even if you’re happy with your current employer-sponsored plan, you may want to add a Rocket Dollar account to add some alternative investments to your retirement plan portfolio mix.

About Rocket Dollar

Founded in 2018, and based in Austin, Texas, Rocket Dollar is an investment platform designed to enable people to take greater control of their retirement savings.

Founded in 2018, and based in Austin, Texas, Rocket Dollar is an investment platform designed to enable people to take greater control of their retirement savings.

Using the service, account holders can invest in any asset class permitted by the IRS.

That includes unconventional assets such as:

- Precious Metals

- Private Equity

- Peer-to-Peer Lending

- Real Estate

- Cryptocurrency

These are all assets you would not expect to see in a typical retirement plan, particularly an employer-sponsored one. It’s also it an advantage over most other investment platforms, that specifically exclude these types of investments.

Rocket Dollar is available for self-directed IRAs and Solo 401(k) accounts. The platform offers “checkbook control” of your retirement account. It enables you to make an investment by writing a check, sending a wire or using a debit card.

How Rocket Dollar Works

Rocket Dollar starts by guiding you through the process of opening a Solo 401(k) or a self-directed IRA. Each account comes with its own bank account, and you can invest in virtually any asset that isn’t prohibited by the IRS.

You can keep track of your investments using the Rocket Dollar investment tracker. You can easily track all investments in your account on an ongoing basis.

To get checkbook control over your account, you’ll set it up as part of an LLC. Rocket Dollar will provide you with necessary articles of incorporation, an operating agreement, and employee identification number (EIN) so you can open a business bank account.

The LLC is owned by your IRA, so you can invest through it.

With a Solo 401(k), you’ll open a trust account. Once again, Rocket Dollar will provide you with plan documents and an EIN document, which will enable you to open a trust account at a bank.

If you also open a Roth account, you will need a second account. You can also create an LLC within your Solo 401(k) if you want to hold real estate in your plan.

Once you have opened a bank account, either through an LLC or a trust, you can then purchase investments of your choice through the account. The bank account is owned by the LLC or trust, which are owned by your retirement plan.

Of course, you can also use your plan to invest in more traditional asset classes, like stocks, bonds, mutual funds, exchange-traded funds, and options. This can be done by holding traditional brokerage accounts within your Rocket Dollar IRA LLC or Trust.

Rocket Dollar Features and Benefits

- Minimum Initial Investment: N/A.

- Available Accounts: Solo 401(k) and traditional, Roth, and rollover IRA accounts.

- Permitted Investments: Single or multifamily rental properties, precious metals, cryptocurrency, undeveloped land, mineral rights, LLCs, LPs, and C-Corps; joint ventures, real estate, and business loans, and even racehorses. You can also invest in more traditional assets, like stocks, bonds, funds, certificates of deposit, and options.

- Mobile App: Not available.

- Customer Service: Live phone support is available 9:00 am to 5:00 pm, Central Time, Monday through Friday. You can also open an electronic ticket or leave a voicemail 24 hours a day.

- Account Custodian: Funds held with Rocket Dollar are held with their preferred banking partner, IRA Resources Trust (IRAR).

- Account Protection: Cash balances are covered by FDIC insurance through IRA Resources Trust. But due to the nature of the alternative investments held in your plan, they are not covered by SIPC. However, if your plan includes a brokerage account to hold conventional assets, SIPC coverage should be available through that account.

- Account Security: Rocket Dollar is a SOC2 certified company, which means they’ve undergone rigorous audits to ensure security standards are always up-to-date and at the highest levels. Originally developed by the American Institute of Certified Public Accountants, it’s defined as criteria for managing customer data, based on security, availability, processing integrity, confidentiality, and privacy.

Rocket Dollar Self-Directed IRAs and Self-Directed Solo 401(k) Accounts

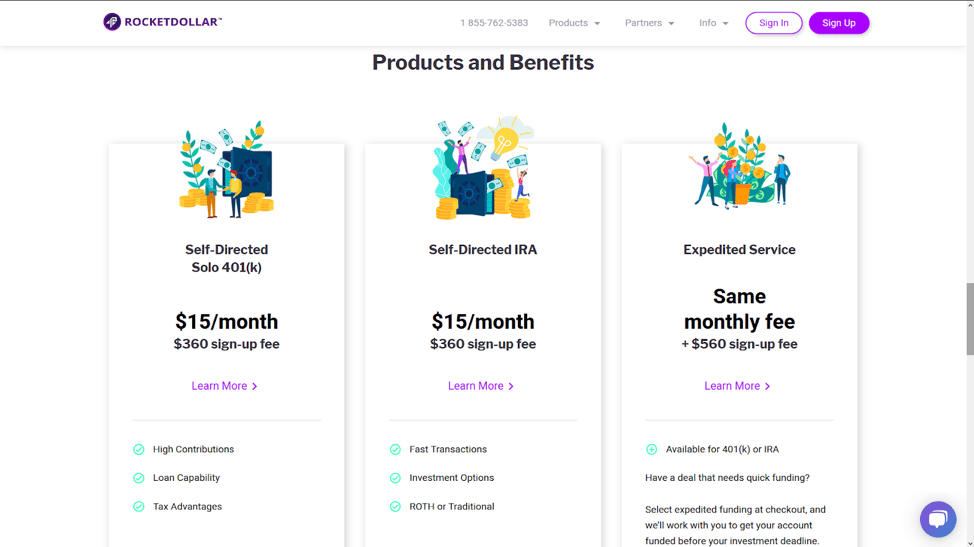

Rocket Dollar offers two basic plans, the self-directed IRA, and the self-directed Solo 401(k) plan.

Self-Directed IRA

The self-directed IRA can be either traditional or Roth. The advantage of a self-directed IRA held with Rocket Dollar is that your investment choices are almost unlimited.

You can hold virtually all the investments that are not available in traditional investment brokerage accounts or robo-advisors.

This means you can add actual real estate, rather than a real estate investment trust, within your account. As noted earlier, you’ll set up an LLC that will be owned by your IRA, and you can make alternative investments through that LLC.

Using the same format, you can also invest in hard money lending, venture capital, and startups and private companies.

Self-Directed Solo 401k

The Solo 401(k) plan works similar to the self-directed IRA, except you set up a trust owned by the plan, rather than an LLC. Your alternative investments are held through the trust. Also, you must be self-employed to set up a Solo 401(k).

A Solo 401(k) plan has the major advantage over an IRA of much larger contributions. For example, you can contribute up to $19,000 per year, or $25,000 if you’re 50 or older, for 2019.

But you can also make an employer contribution of up to 25% of your compensation on top of your employee portion. The total of the employee and employer contributions can be as high as $56,000, or $62,000 if you’re 50 or older.

The Solo 401(k) plan not only allows you to accumulate a large retirement plan quickly, but it will also provide a very large tax deduction. In addition, a Solo 401(k) plan also allows you to borrow money against the plan. You can borrow 50% of the value of the plan, up to $50,000.

Rocket Dollar Pricing and Fees

Rocket Dollar works on a flat monthly fee of $15. That will be beneficial for larger investors. For example, if your account has $100,000, $15 per month will be $180 per year. That works out to be 0.18% on an annual basis, which is lower than the typical 0.25% to 0.50% fee charged by Robo-advisors.

On a percentage basis, the fee will be high on smaller accounts. For example, with an account balance of $10,000, $180 per year will be a fee of 1.8%.

Rocket Dollar also charges a one-time sign-up fee of $360. This raises the $560 under the Expedited Service, which will enable you to participate in a deal that needs funding quickly.

There are no transaction fees with a Rocket Dollar account since all investments will be purchased directly using your LLC or trust bank account.

All fees can be paid with a debit card linked to your retirement account, or by a credit card if you prefer to preserve your retirement assets.

(Source URL: http://bit.ly/2Y7498c)

Rocket Dollar Pros and Cons

Pros:

- The flat fee of $15 per month will be especially attractive to larger investors since they’ll pay a lower percentage fee than they will on most investment platforms.

- Rocket Dollar allows you to invest in more asset classes than other platforms, including precious metals, cryptocurrencies, and peer-to-peer lending.

- Rocket Dollar also specializes in self-directed Solo 401(k) plans. These allow you to make much larger contributions, giving you a larger tax deduction, as well as the ability to take loans against the plan.

- A self-directed IRA or Solo 401(k) plan with Rocket Dollar can be the perfect addition to your retirement portfolio mix, to hold alternative investments with more traditional ones.

Cons:

- There is a $360 sign-up fee.

- The monthly fee – especially in combination with the sign-up fee – will be expensive for smaller investors when compared to other investment platforms.

- Customer service is limited to regular business hours only.

- No mobile app is offered with the service.

Should You Sign Up with Rocket Dollar

Rocket Dollar is a highly specialized retirement plan investment service, and not suitable for all investors. It will work best for those who understand alternative investments and have the risk tolerance to include them in their retirement savings.

It’s also an excellent option for anyone who already has a substantial retirement plan, concentrated in more traditional investments, like stocks, bonds, and funds. A Rocket Dollar account will provide you with an option to add alternative investments to your overall retirement plan mix.

It will work especially well for those with larger account balances – especially over $100,000 – since the fee structure will effectively be lower than most robo-advisors.

But since the investments held in Rocket Dollar are true alternatives, this isn’t a good choice for anyone who isn’t familiar with this type of investing. It’s higher risk than traditional investments and requires specialized knowledge. Another important factor is that Rocket Dollar doesn’t manage your investments for you. You’ll be completely responsible for all investment management.

As well, the fee structure of $15 per month will be excessive on smaller accounts, particularly those below $20,000 or $30,000.

But if you have a larger account, an appetite for greater risk, and at least some knowledge of investment alternatives, Rocket Dollar is the perfect retirement platform for you.

If you’d like more information, or you’d like to sign up for the service, visit the Rocket Dollar website.

The post Rocket Dollar Review appeared first on Good Financial Cents®.

Source Good Financial Cents® http://bit.ly/31I9x3X

ليست هناك تعليقات:

إرسال تعليق