السبت، 31 أغسطس 2019

Getting Through the “Boring Middle”

Most life changes go through three major steps.

At the start is the “honeymoon phase.” You’re enamored with the big goal you’ve set for yourself. You’re having fun exploring all the new changes you’re making in your life. It’s all novel and interesting. You’re seeing those first steps of progress and it’s super exciting.

At the end is the actual achievement of the goal, which feels great. You did it! You’re able to retire with a healthy retirement income. You’re able to finally launch your business. You’ve lost X pounds. That’s fantastic!

It’s the middle that’s the problem.

The “boring middle” is all of those steps that have to happen after the excitement of the “honeymoon period” wears off but before you even get close to the goal (it can get kind of exciting once you get pretty close to the goal and the destination starts to feel like it’s about to happen).

This is particularly true for financial goals. The “boring middle” for a lot of financial goals is to just keep working and earning an income while the savings for that goal happens automatically.

As the saying goes, “the devil finds work for idle hands to do.” If you’re in that “boring middle,” it’s very easy to find yourself starting to desire the best parts of your old lifestyle before you adopted change. It’s very easy to feel like your current life is “boring.” It’s also quite easy to feel like you’ll never really reach that overall big goal, so what’s the point?

It’s those very temptations and distractions that convince people to “fall off the horse” of their long term goals and fall back into old patterns that don’t lead to the place they want to go. They might still want that long term goal, but the short term temptations and the lack of enjoyable progress overcomes that desire for the big goal.

I’m in the “boring middle” of my own big financial goal, which is essentially a very early retirement for Sarah and myself. We want to spend our fifties doing a lot of things that just don’t make logistical sense with three kids at home, and part of that is having complete freedom from having to work for money (this doesn’t mean that we don’t want to work, we just want to be able to make work decisions without the need for income being a requirement in those decisions).

There is definite “boredom” in the march toward my long term goal, and along with that some temptation to enjoy short term perks. I absolutely feel that tug at times. It would be fun to freely spend some of the money we’re channeling into savings and do some rather pricy things.

What keeps that from happening, though? How do I get through the “boring middle” of my big financial goal? These are some of the things I’m doing that are really helping me stay on the right track. Some of these are transferable to other goals, like weight loss, while others are mostly only applicable to financial goals.

So, let’s dig in. Here’s what I’m doing to try to stay on the right path through the “boring middle.”

Focus on Systems and Daily Routine

This has been a regular theme on The Simple Dollar as of late because I’ve found it so essential as a bridge through the difficult middle parts of many goals, keeping me going when I want to quit.

Rather than focusing on the big goal, my focus is on establishing daily routines and systems such that a normal day naturally takes me a few steps closer to my goal. What kinds of things can I do as the natural part of my day that will move me toward that goal?

Furthermore, I ask myself a variation on that question: what would a financially successful person do today? My big goal implies that I’m a financially successful person, right? That’s who I want to be, right? So, what does a financially successful person do on a typical day?

I list out those traits and behaviors and basic steps, and then I try to live out as many of them as I can, making them into my normal behavior. Some of them are small habits and specific things to do, which I can handle with checklists or to-do lists until they become completely second nature. Others are more behavioral changes, and with regards to those, I use the systems described in the book Triggers.

For example, what does a financially successful person do each day?

They don’t spend money on foolish and frivolous things without some forethought. That’s a behavioral change I can always work on.

They have automatic transfers and paycheck deductions in place that move their money for them and move them toward their big financial goals. Check.

They don’t needlessly tempt themselves. That’s a behavioral thing I can work on.

I can go on and on listing traits and behaviors and habits like this. The more of them that I adopt, the more I am behaving like a financially successful person, and the more that become natural, the more I naturally am a financially successful person.

You can do this for any big goal. What does a healthy person do every day? What does a fit person do every day? What does a smart person do every day?

I do this myself for other goals with questions like: what does a black belt do every day? What does a well-read person do every day?

Rather than worrying about your big goal, focus on this as a daily goal. Your goal today is to be a financially sound person. If you pull that off well, then your big financial goals will become inevitable.

Have a Lot of Milestones, with Celebrations That Don’t Disrupt the Goal

With almost any enormous goal, there’s a lot of value in breaking it down into progressively smaller pieces. I discussed one system recently, the 5-4-3-2-1 system and how to apply it to financial goals, but this is really about those middle steps, the “3” part of 5-4-3-2-1.

What you’re seeking out is things that constitute a significant step forward toward your big goal somewhere in the timeframe of one to six months. You might choose something like paying off a debt or reaching a certain net worth value or maxing out your Roth IRA for the year. It really depends on what your big goal is and how you’ve broken it down.

When you achieve that medium-term goal that fits into your big goal, find some way to celebrate it. Do something with your wife or with a few close friends. Spend a day doing something fun.

Whatever you do, though, make sure that it’s in line with your goal and isn’t undoing part of it. Don’t celebrate achieving a new low weight by eating a whole pizza and a pound cake. Don’t celebrate a new peak net worth by going on a giant spending spree. Don’t celebrate a new low time on your 5K by sitting on the couch for a week. Find ways to celebrate that don’t undo your goals. Tap into resources you’re not using, like time and energy, rather than the resources you’re using.

I usually celebrate a financial milestone by giving myself a day off of work to have a one day “staycation” to literally do whatever I want. I usually just spend a day delving deep into a hobby. I’ll spend the morning making something, spend the afternoon reading a book, and spend the evening playing a six hour long strategic board game with friends. It’s a wonderful day that doesn’t undo my financial progress. I plan it out in advance and look forward to it.

Find Things You Enjoy Within Your Current Lifestyle

For a lot of people, financial change usually comes along with abandoning a few routines in life that they enjoy. For example, many people delve into their daily routine, find things that they were spending money on every day, and cut them out of their routine.

While this is a great first step, what often happens is that when people hit the “boring middle,” they really start to miss those things that they cut out and they regret getting rid of them. It often starts to create a feeling of unhappiness in life and a sense that there aren’t things to enjoy in life any more.

That’s a bad path to start going down because it almost always ends in either resentment or an abandonment of the big goal.

A much better approach is to find lots of things that you enjoy within your current life so that you don’t miss the things you used to do nearly as much.

When I went through my financial turnaround, I cut a lot of expensive routines out of my life. I gave up golf. I stopped going to the bookstore more than once a month or so. I stopped going to the coffee shop more than once a month or so.

What kept me from missing them after a while was the fact that I didn’t merely replace those things by just sitting at home and feeling bored and feeling self-pity. Rather, I intentionally started finding other things to do with my time.

I started visiting the library and checking out armloads of books, making it my goal to have a big fat list of books I’d actually read than ones I merely owned. I started learning how to cook for myself and experimenting in the kitchen. I got into disc golf, which basically requires a couple of frisbees, and there were multiple free courses close to where I lived. I started participating in a few community organizations and I started going to several meetups. I started getting into hiking. I made it an effort to try new things all the time, too.

Those things filled my time and my thoughts and pretty quickly and efficiently replaced the expensive things I was doing. This went a very long way toward killing the sense of something missing in my life. I wasn’t sitting at home bored – I filled my life with other things.

You can do this with lots of personal goals. If you’re tackling a dietary goal, find lots of foods you like that are in line with your new dietary direction and fill your cupboards with them so that you always have an abundance of choice. If you’re tackling a fitness goal, find a variety of exercises you enjoy that meet your fitness needs so that it doesn’t feel like a drag.

Focus on Other Significant Life Goals with Tangential Benefits to Your Current One

When you’re in the “boring middle” of a big goal that’s occupied your mind for quite a while, it’s easy to just feel burnt out. There’s nothing new to try, it all feels stale, you want something different.

Often, that sense of wanting something different leads straight back to undoing the things that got you to that “boring middle” to begin with. You give up on the goal and revert back to bad habits just to change things up.

A different approach – and one that has worked well for me – is to simply dive into a new goal in life that tangentially helps the previous goal. Combined with having a good set of daily systems and habits, described above, this tends to keep things fresh as it allows you to change focus as needed.

For example, I have five major life goals going on right now that will each see completion sometime in the next one to ten years. I have minimal things I do to move forward on each one, but I find that my intense focus moves from goal to goal. For a while, I’ll be really focused on frugality and cutting spending, but then my focus will shift to working toward my taekwondo black belt, but then my focus will shift to a writing project. While my focus is on something else, I still maintain basic daily steps toward the big goals, but my intense focus is elsewhere.

Most of these goals have synergy with each other, something I’ve discussed before. I view life as being made up of nine or ten spheres: financial, physical, mental and spiritual, intellectual, marital, parental, professional, and social, and they all overlap in different ways. Each of those links, in fact, goes to an article outlining how those areas overlap with one’s financial life. Many of the goals people choose in life directly benefits one or two spheres and then indirectly benefits several others.

For example, one of my major goals right now is earning a black belt in taekwondo. This is a physical goal, as it aids my fitness and health, and a mental goal, but this connects to other areas. It helps me to focus, which helps with professional work, which earns money, which helps financially. It helps me improve my health, which reduces health care costs long term, which helps financially. When I work on this goal, as long as I’m not throwing money at it (which I rarely am), there is indirect financial benefit, plus I’m finding something else to focus my energy on so that I don’t get “worn out” by financial goals.

If you find that you’re in the “boring middle” with a big goal, seek out another big goal in life that doesn’t undermine your current goal. You’ll probably find that there are a lot of little synergies between the two and thus throwing yourself into one goal doesn’t undermine the other and in fact indirectly aids it. Plus, it’ll give your mind and body something else to work on rather than the proverbial devil finding work for idle hands to do.

Surround Yourself with the Right Culture

I’ve touched on these factors in various ways before as separate things, but they really come together as one core idea: you need to be enmeshed in a culture that’s supportive of the direction you want to go in. Financially strong people generally don’t emerge from cultural situations where everyone is living paycheck to paycheck and accumulating debt, for example. You have to find cultural elements with which to surround yourself that encourage financial progress.

So, how do you do that? One healthy step is to hang out with people who are headed in a financially positive direction. Develop friendships with people who aren’t always buying tons of things and are focused on other areas of their life. This doesn’t mean abandoning relationships with more materially-oriented people, but simply building friendships with those who are less materially oriented.

You can also cut down on media consumption that lauds lifestyles in opposition to what you’re working for, and increase media consumption (if you want to) of things more in line with what you’re working for. Stop watching things that are about people who spend lots of money and are rampant consumers. Stop watching things that are loaded with ads or have lots of product placement. Stop watching and reading “news” reports that are little more than ads for new products. Instead, look for sources of entertainment and news that don’t have that focus. What news sources don’t waste time covering new products or other things to buy? What television shows focus on areas of life that don’t involve buying lots of stuff or buying expensive things? What things that you watch or read are loaded with ads? If you can, look for things that actually show the opposite, ones that show frugality in a positive and normal light and ones that show financial progress and hard work as good things.

All of these moves will nudge your thoughts much less in a consumer-oriented direction and much more in a financially responsible direction.

Find Contentment and a Positive Mental State

One final tip, and one that underlies all of these things, is putting in the effort to find contentment and a positive mental state in your life. This means things like reducing stress, recognizing and having gratitude for good things in your life, having an abundance viewpoint about life, having a growth viewpoint about life, realizing that you have “enough” in your life, and recognizing and appropriately treating depression and other conditions. This does not mean being constantly happy or anything like that.

All of these steps are pointing to the same core idea: your life is actually pretty good, especially in the scope of human history, and there are many good things within that life. Capturing that feeling goes a long way toward killing that sense of inadequacy and not having enough that often drives our worst spending impulses.

Again, this does not mean that you’re in a perpetually happy state. Rather, it means that adding more stuff to your life, particularly buying more stuff and consuming more stuff, doesn’t make you happier. Money doesn’t buy happiness. It merely buys little bursts of fleeting pleasure, but then the lack of money actually brings stress and a lack of contentment and that can lead to unhappiness.

Make a conscious effort not merely to find things that make you happy, but to recognize that your life is already abundant and that you don’t really need more – you have enough already, and things are actually pretty good, even if you’re not necessarily happy right now. (We all feel melancholy sometimes, and companies even prey on it.)

Having that kind of mindset makes it easier to handle the “boring middle” of a big goal, particularly a financial one, because it is much easier to recognize that your life is already abundant. Achieving that financial goal just secures that abundant life and opens up even more opportunity, whereas spending money with reckless abandon closes those doors.

Final Thoughts

The “boring middle” of any goal can be dreadfully challenging, particularly as you’re adjusting from the end of the honeymoon period and you’re recognizing that there’s a lot of work ahead of you without a ton of novelty.

Thankfully, there’s a set of tools you can use to help you get through that “boring middle.” Focus on systems and daily routine. Have a lot of milestones, and celebrate them in a non-disruptive way. Find lots of things you enjoy within your current lifestyle approach. Work on other major life goals. Build up the right culture around you. Find contentment and the right mental state. Those tools will make the “boring middle” much easier to get through as you make your way to the goals you’ve always dreamed of.

Good luck!

The post Getting Through the “Boring Middle” appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2PyaDx1

الجمعة، 30 أغسطس 2019

Frugality, Philosophy, and Time Management

In Monday’s reader mailbag, Eric asked a great question:

I find it interesting that you write about things like time management and philosophy on a personal finance site. The connection seems thin at best to me. I’d love to see a post talking about it.

My first line in response was “I don’t think there’s a full post in this subject, but there are certainly a few paragraphs.”

After the article posted, however, Eric and a couple of other readers asked enough follow-up questions that I changed my mind and decided that, indeed, this topic deserved a full article on its own.

So, let me answer Eric’s question from the top.

Frugality Is Resource Management

The idea of frugality is almost always tied to money and maximizing the effectiveness of it. However, I tend to use a somewhat broader definition of frugality. To me, frugality is about maximizing the effectiveness of all of one’s resources. Money is obviously a big one, but those resources also include time, energy, focus, relationships, skills, health, and other things.

The reasoning here is that if you find a way to be efficient with any one resource, it eventually can translate itself into money. For example, if I am efficient with my time and focus when I’m working, I get done with my work earlier than expected. This gives me some extra time to do some meal prepping (saving money directly) or doing something that builds professional skills (helping me earn money later) or exercise (improving my health, reducing health care costs later) and so on.

This works because most of life’s resources can be converted into money, and vice versa.

Time can definitely be converted into money, as you have more time to work or build skills or build a side business or do frugal projects.

Energy can be converted into money because you feel energetic enough to do more in a given day, like do a meal prepping project or finish off a work project.

Health can be converted into money because you’re avoiding health care costs and side effects that can sap your energy and time (which converts into money, as noted above).

Focus can be converted into money because it means more efficient work and usually higher quality work. You get things done faster (giving you more time) and you get things done better, usually increasing the value of whatever it is you’re doing.

Relationships can be converted into money by reducing the expense of help when you need it and increasing your professional and personal opportunities.

Skills can be converted into money by doing things yourself (saving money) and selling those skills and earning money.

Thus, frugality isn’t just about efficient use of money, it’s really about the efficient use of all of those resources (and others).

Best Techniques for Each Resource

Because of that, I think there’s a lot of frugal value in seeking out and finding best practices in each of those areas.

For example, when we’re looking at time management, I use a number of techniques that really help. I constantly have a task list going (I use the program Omnifocus to manage mine). I always have a pocket notebook and pen in my pocket to jot down thoughts and information as they come to me so I don’t lose them. I use time blocking as a way of effectively budgeting my time, and I even use time tracking as a way to more deeply understand my time use. All of this is intended to get maximum value out of my time.

Another great example comes from focusing. I do a lot of things to aid my focus, from mindfulness meditation and writing in a journal each day to listening to ambient noise and alternating between drinking coffee and green tea while I work. These tactics really help me focus in on my work, which means I produce better work in significantly less time than I would if I didn’t use these tactics. They also help me to naturally focus in the moment on things like my family or my friends or on a task I’m taking on at the moment.

I could go through most of these categories and point out strategies I use that I consider to be the best practices for making those categories more efficient. For example, I use a lot of checklists for tasks just so I don’t have to think about them or think about what’s next. The key is that I’m sharing what actually works for me in terms of getting more efficient value out of one of the resources in my life, and that resource can usually be converted to money (or into leisure time, which is as good as money).

People Do Focus on Money

The issue, of course, is that people who come to The Simple Dollar almost always have a heavy money focus. Usually, they’re drawn to The Simple Dollar because they’re experiencing a financial challenge in their life and they need some down-to-earth advice on how to fix it.

This isn’t surprising. Just shy of 4 out of 5 Americans live paycheck to paycheck. Inevitably, some of those people start feeling nervous about their situation, and others are hit by an unexpected event and suddenly find themselves in a really stressful financial state. Money is the resource that they need to get a grip on in that moment, more than any other.

That’s why, when I do focus on those other areas, I try really hard to make the connections to money as clear as possible. Often, the main reasons I use for those tactics aren’t directly related to money. Usually, I do them because they make some other resource in my life more efficient and then, over time and as needed, that resource saves me money. However, understanding that isn’t really all that helpful to someone seeking immediate financial help. Money is the resource that people are often concerned with, and thus I try to make the connections to money as directly clear as I can.

On the whole, though, The Simple Dollar is really about having a balanced, low stress, financially successful life where you’re achieving the dreams you have for yourself.

What does that really mean, though?

A Philosophical Approach to Life

Sometimes, articles on The Simple Dollar trend in a very philosophical direction, asking questions about what our purpose in life is and what we want out of it. Those questions aren’t easy to answer and they’ve been the core of philosophical works since the dawn of time. You can literally go back to the earliest philosophers and you find that they’re thinking about those questions and philosophers today are still thinking about it.

In my own life, getting a grip on the purpose of my life has been infinitely valuable in terms of figuring out what I should be doing with my money, time, and energy. It was essential in setting meaningful lifelong and long term goals, and those inherently lead what I choose to do with my resources. I use frugality tactics to help me move toward those goals efficiently.

Everyone has a different understanding of their purpose in life. I think that anyone can benefit a whole lot by reading some of the better works on life philosophy out there and figuring out what really clicks with them, because it won’t be the same thing for any two people. I’ve written about stoicism and Epicurean principles and Aristotle’s principles and secular Buddhism and books like “Walden” and Voluntary Simplicity and Self-Reliance (in three parts).

(If you’re interested, my own belief is that the purpose of life is to find out what you’re good at and practice it with enough skill and focus that you lose track of time and space and achieve a “flow state.” This flow state feels tremendously good, produces really high quality results, and can be used in both professional and all manner of personal contexts. I can dig into that idea in a bunch of ways, theologically and psychologically and philosophically, but I basically think that the best life I can lead is one where I regularly get into a flow state and the things I produce while in that state make the world a better place. I think this approach helps greatly with my writing, but also makes me a better parent and a better husband and a better friend and some of the things I do in that state help many, many people. Having said that, however, I think that everyone has a different view of what their own purpose in life is and you should seek your own and not expect it to match mine.)

When I write about such subjects here, I try to center it around things that I’ve learned that resonate with me, but also with ideas that I can at least appreciate that I know resonate really well with others. I want everyone to be able to figure out at least some idea of what their own purpose is, so that they can set more meaningful life goals and put their finances to work in service of it. Not only does this provide a ton of motivation for good financial behavior, it also translates your financial success into something that’s deeply personally meaningful for you.

Final Thoughts

Whenever you read an article on here that delves into time management or into checklists or into meditation or into something philosophical, there are really two key things to remember.

One, frugality is about getting maximum value out of all of life’s resources and those resources are generally transferable to one another. If you’re efficient with time, it’s easy to convert that time savings into money. The same is true with energy, health, relationships, focus, and so on.

Two, having a purpose in life makes it much easier to set long term goals that really resonate, and putting your finances to work in line with those goals makes financial progress much more powerful and meaningful. When you really figure out what you want out of life and start setting goals to maximize your ability to do whatever that is, the financial moves you make in service of that goal seem incredibly joyful and purposeful because you’re building a life that really means something to you.

Those things are big cornerstones of personal finance, in my opinion. Know why you’re doing this. Get maximum value out of all of life’s resources. That’s the path to not just financial success, but success in life.

The post Frugality, Philosophy, and Time Management appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2NHwQq2

Dear Penny: My Family Keeps Asking for Money and It’s Bleeding Me Dry

Dear Stuck,

You could take a second job. You could get a side hustle or five. You could work 100 hours a week or more. Heck, you could work so much that you quit sleeping if you really want to keep bailing out your family.

But I suspect you already know the answer to your question: You can’t keep providing for so many people and keep your savings intact. Your family is using you as a walking checking account. As long as you keep depositing money, they’ll keep making withdrawals.

Right now, you’re not in a position to financially assist family members. Think back to the instructions at the beginning of every flight you’ve ever taken and how they always tell you to put your oxygen mask on first before helping anyone else in an emergency. The reason, of course, is that you can’t help someone else if you pass out because you’re deprived of oxygen.

The same principle applies here: You’re out of savings, so you can’t help anyone, including yourself, in an emergency.

Schedule a time to go over the gamut of your finances with your wife, including how much you’re bringing in, how much you’re spending — both on your own expenses and for family — and your short- and long-term goals.

A goal to prioritize is rebuilding your savings, which is especially important since you have irregular income. Until you have several months’ worth of living expenses saved, I’d strongly suggest you both commit to not forking over cash until you’re on more solid financial footing.

Since your dad has hit you up for cash twice in the past few months, you need to tell him that you’re not in a position to help out. The reasons he needs money don’t matter. Keep the focus on you and how you don’t have the resources to bail anyone out.

The key is to communicate this soon. That means before he’s on the phone begging for money. Be prepared to say no and keep repeating it the next time he asks for help.

Don’t be swayed by any promises to pay you back. You can’t afford to loan money if you can’t afford to make that money a gift.

With your mother, you should have a talk about the financial stress you’re feeling — which there’s a good chance she’s experiencing too as she hunts for a job. Talk to her about if there are ways she could earn extra cash to contribute, whether it be through walking dogs, delivering groceries or babysitting. Even a contribution as small as $50 a week could relieve some of the pressure.

Once you’re in a better financial situation — meaning a healthy amount saved and you’re earning more than you’re spending — you may decide that you’re willing to help out family members in certain circumstances.

If so, setting limits before relatives hit you up will be key. Decide how much you can afford to offer if a family member needs money. Consider opening a separate savings account that’s earmarked for that.

Just know that when someone asks you for money, they’ll often make it sound like an either/or situation, i.e., either you loan me money or I experience the worst-case scenario, whether that means being evicted, having a car repossessed or having an account sent to collections.

But often it’s not. Being cut off from an easy source of cash can be a source of motivation. People find ways to earn extra cash or work out a plan to get caught up on payments. Or at the very least, they find someone else to hit up.

Just focus on how much you can afford to help out — and if you aren’t in a good place financially, that amount is zero.

Robin Hartill is a senior editor at The Penny Hoarder and the voice behind Dear Penny. Send your questions about money worries to AskPenny@thepennyhoarder.com.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

source The Penny Hoarder https://ift.tt/3497yqp

'My mortgage is a millstone' the exes trapped together in a home-loan nightmare

Source Moneywise - 29 years of helping you with your finances https://ift.tt/34eGN3M

I’m from Brazil and have never paid National Insurance. Can I start now?

I am 86 and was born in Brazil but I have lived in the UK since 1999.

I have dual citizenship.

Despite being here 20 years, I have never paid National Insurance, mostly because of ignorance. I have always taken on low-paid jobs, mostly earning around £650 per month.

When I started at one company, they asked for my National Insurance number but then said I was already over the age for paying NI anyway and I didn’t need one.

So here I am, in good health, still working to keep myself active, but with no prospect of having a state pension. Last week I applied for my NI number and I have an interview soon.

If they give me an NI number – despite my age and low earnings – will I be able to backdate and pay for Class 3 NI contributions for the past 10 years, so that I can apply for state pension straight after? And where would I go to calculate these contributions?

Class 3 National Insurance (NI) contributions can be paid by people to fill in gaps in their record to qualify for benefits such as the state pension.

However, there are two issues that mean you won’t to be able to backdate your claim for NI contributions. The first is that you were over state pension age when you came to the UK and you are unable to pay NI contributions for years after state pension age. In addition, you would only be able to backdate a claim for six years and you need to have 10 years to receive any kind of state pension entitlement.

You don’t mention if you are single or married in your letter but if you are single, then given your current earnings, you should be able to claim Pension Credit, which would bring you pretty much up the state pension level anyway. Please note that any savings you have will be taken into account when eligibility for this benefit is being assessed.

Source Moneywise - 29 years of helping you with your finances https://ift.tt/2UiHLI4

الخميس، 29 أغسطس 2019

Retailer Forever 21 reportedly heading for bankruptcy

Source Business - poconorecord.com https://ift.tt/349x92D

How to Start an Online Store That Drives Sales

The best platform for starting an online store is Shopify. That’s what we use for all of our ecommerce websites. Creating your online store, is just 1 of 6 critical steps, which this guide will take you through in detail.

Start your free trial with Shopify today and create your online store in just minutes.

There’s a bunch of things to think about when starting an online store:

- What tool do you build your store with?

- What do you name your company and how do you get a domain?

- Do you dropship or not?

- How do you deal with taxes?

All of these are important decisions. For now, one thing matters more than anything else to get your first sale.

What’s that one thing?

Your marketing.

That’s right, how you choose to market your store completely determines how much money you’ll make. Get the marketing right, everything else falls into place. Get it wrong or neglect it, you’ll spend years on your store without selling a single item.

There’s 6 Steps to Starting and Launching Your Online Store

- Pick your marketing strategy.

- Find the right product niche.

- Pick a name for your brand.

- Create your online store.

- Do a 60-day marketing burst.

- Build your marketing flywheel.

Step 1: Pick Your Marketing Strategy

Before you open your online store, you need to pick your marketing strategy. Don’t even look at templates for your storefront, or color palettes, or logo designs, or anything yet. (We’ll get to the how to setup an online store stuff soon — I promise.) First, pick your marketing strategy.

If there’s one step that will make or break the success of your online store it’s this one. It’s not a hard choice, but it is one that you need to make thoughtfully and in advance.

Most online stores use one of three marketing strategies:

- SEO

- Paid marketing

- Platform marketing

Let’s go through each.

SEO for Online Stores

This marketing strategy is pretty simple: find keywords for products that you want to offer, then get your site to rank in Google for those keywords.

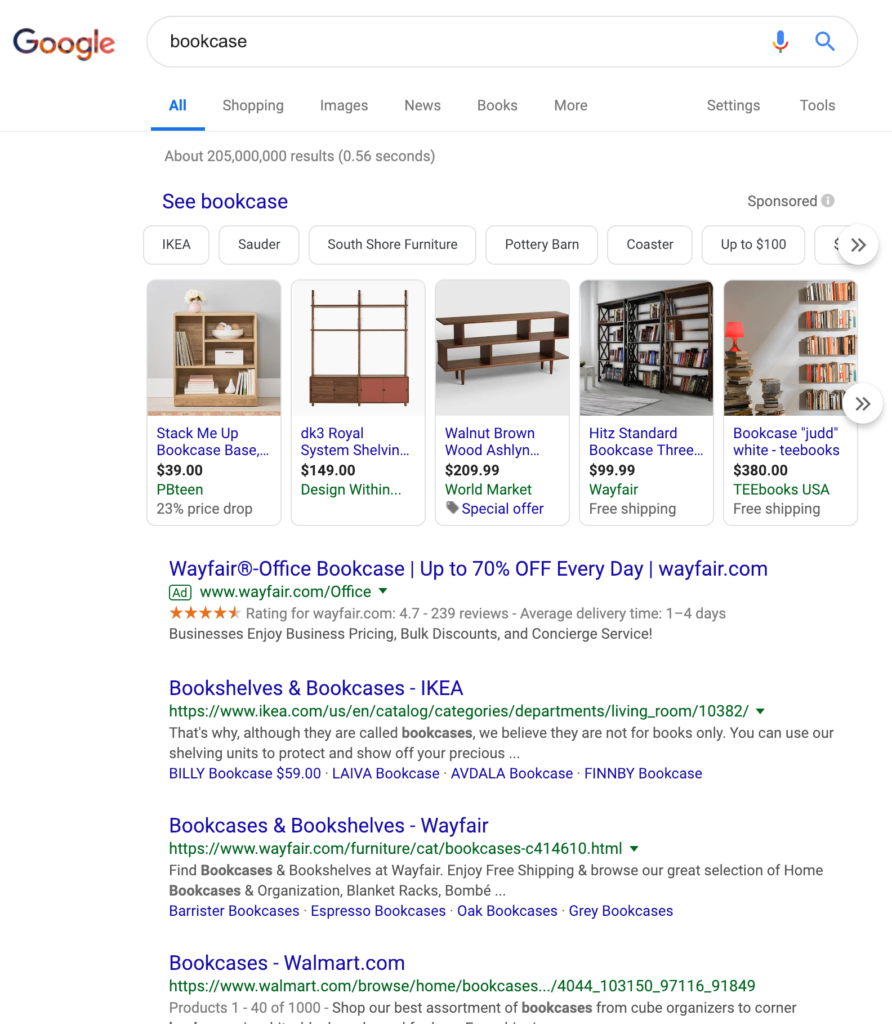

In this example, IKEA, Wayfair, and Walmart.com are winning the organic spots (the ones underneath the carousel and the ads) SEO for the search term “bookcase.” If you get this strategy to work, you can make a lot of money with your online store.

SEO has a few benefits that are ideal for a businesses:

- The traffic streams are very dependable, which means dependable revenue for your business.

- Search traffic usually has the highest volume of traffic of any traffic source.

- Even at scale, search traffic can be enormously profitable.

Dependable, high volume, and profitable. It’s everything you could want.

There is one major downside: SEO takes a lot of time and effort. Even if you’re pursuing a product category without any competitors, it can still take a good 3–6 months to see your site appear on the first or second page of search results for a keyword. The traffic volume will be pretty small until you get your page into the top 1–3 rankings on a keyword. If your category is even modestly competitive, it can take years of effort to get to that point.

If you go with SEO as the marketing strategy for your online store, you’ll focus on three things:

- Optimizing your product pages for product keywords.

- Building useful and engaging content for non-product keywords that are also in your category. This helps your product pages rank.

- Making your content so good that people will link to at as a resource.

When playing the SEO game, there are only two things that matter: content and links. So that’s where you’ll spend the bulk of your time.

Paid Marketing for Online Stores

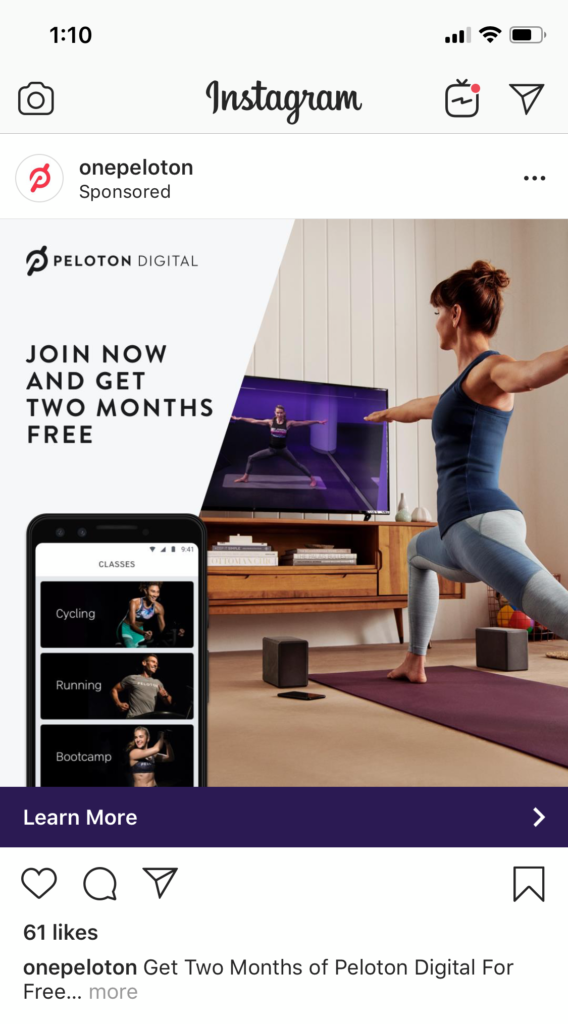

Some online stores do exceptionally well with paid marketing. This includes sponsored posts on Instagram and Facebook, and paid results in Google search. Paid marketing are ad placements you buy.

But is paid marketing right for your business? My general rule of thumb: paid marketing is a great option if your product is the type of thing that could be featured in a mall.

Why?

The biggest paid marketing channels right now are Facebook and Instagram. Instagram in particular has gotten very popular for online stores in the last few years.

But think of the frame of mind that someone has while scrolling through a Facebook or Instagram feed. They’re relaxing for a few minutes, laughing at a few photos, and leaving quick messages for a few friends. They’re enjoying themselves. It’s a lot like how people shop at a mall. Sometimes, people are looking for a particular item, but a lot of people go to the mall to enjoy themselves. Malls have known this for a long time and stores have optimized around this browsing experience.

Products that sell effectively in a mall are also likely to do well with a paid ad in Facebook or Instagram. These products typically:

- Consumer products. Business products have a much harder time in these channels.

- Highly visual and eye-catching. This is why apparel companies do so well in malls and why apparel companies have been really aggressive on Instagram the last few years.

- Simple to understand. The offer needs to be understood within 3 seconds. If you have a more complicated sales process that requires more explanation, people will have scrolled past your ad long before you have a chance to make the sale.

- An impulse friendly price point. If the price is too high that people need to carefully think through the decision, they’ll skip your ad and quickly forget it.

If your product meets all these criteria, you should seriously consider going the paid marketing route.

Google Ads (formerly AdWords) is one exception to this. Since you’re bidding on keywords within Google, you put your ad in front of people who are already actively searching for that type of product. As long as the keyword has enough search volume and the ad bids aren’t too competitive, it’ll work very nicely.

The biggest downside to paid marketing is that you’ll have to invest a bunch of money up front before you know whether or not you can turn a profit. Many of us don’t have those thousands of dollars to invest without a reliable chance of getting it back.

Most paid campaigns don’t turn a profit initially; they usually take a lot of iteration and work before they start making a profit. Most professional paid marketers need 3–6 months before their campaigns become profitable. So be careful and make sure you don’t invest more than you can afford to lose here. If cash is too tight for you, choose one of the other marketing options.

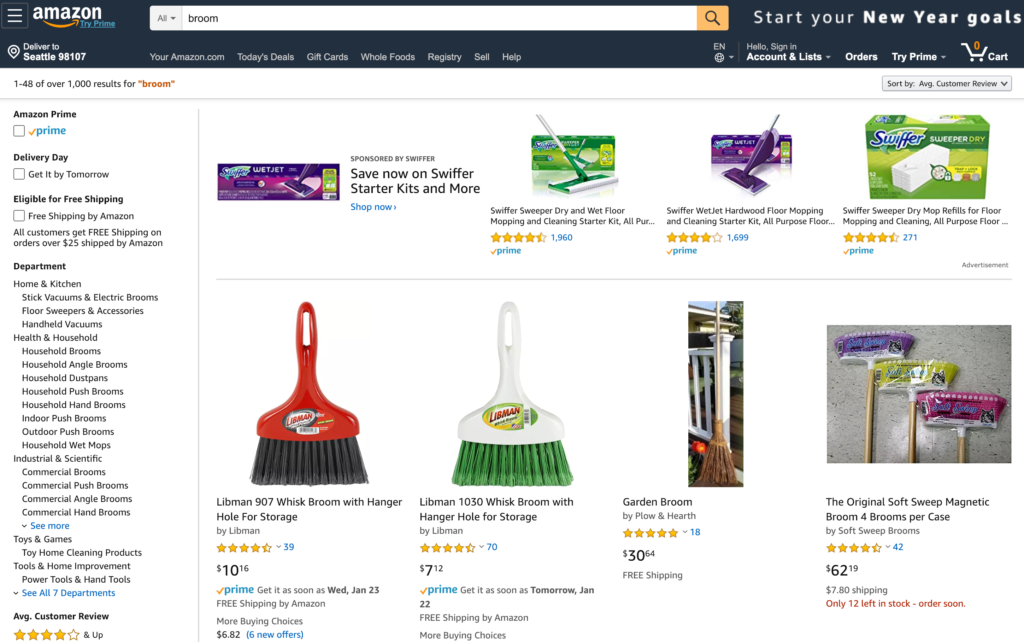

Platform Marketing for Online Stores

This is a completely different direction than the two methods above.

Instead of creating your own store and using a type of marketing to acquire traffic, you’ll leverage one of the main ecommerce platforms:

- Amazon

- Etsy

- eBay

It’s definitely possible to be successful at any of these three. We recommend that most folks go after Amazon. Amazon’s audience is much larger which gives you more upside and just about every product niche already exists on Amazon.

The main exception is if you’re doing a craft business of some kind, like making your own bookends to sell to people. In that case, Etsy is a better fit since the audience expects more craft-oriented products.

eBay is still great if you’re doing a bunch of buying and reselling. But if you’re producing the same types of items consistently, the potential on Amazon is much higher.

You treat whichever platform you choose as your marketing channel. First, you’ll create your store on that platform and list all your products. Second, you’ll optimize your store to the best of your ability so the platform wants to feature your products.

Optimizing your store usually involves focusing on two areas:

- Targeting your product pages to specific terms searched for within the platform

- Getting as many 5-star reviews on your products as possible

As you improve your search terms and reviews, more people will see your products on that platform, which will produce more sales for you.

How to Choose the Best Type of Online Store for You

Let’s recap what we’ve covered so far. There are three types of online stores you can open. These types are based on the marketing strategy you employ.

The three marketing channels for an online store are:

- SEO — You’ll focus on content and links. Requires: time and patience

- Paid marketing — You’ll pay for placements. Requires: 3–6 months, money upfront, and a highly visual, simple-to-understand consumer product with an impulse-friendly price point.

- Existing platforms like Amazon, Etsy, and eBay — You’ll focus on winning the search terms within that marketplace and stacking up 5-star reviews. Requires: Committing to understanding that platform.

I strongly recommend that you pick one of these and build your entire business around it. That’s right, just one.

“Why can’t we do more than one? Wouldn’t we want to use multiple marketing channels for our store? More marketing means more sales right?”

I’ve made this exact mistake so many times myself. After a decade working in online marketing alongside some of the most well-respected marketers out there, I’ve noticed one overwhelming trend: folks that are good at one type of marketing are generally pretty bad at the others.

Why would this be?

A couple of reasons why it’s hard to be good at more than one kind of marketing:

- Every marketing channel is completely unique. While some marketing principles apply across all channels, you’ll have to learn all the tactics from the ground up. Constantly trying to learn new channels really slows you down.

- Online marketing channels constantly change. What works right now won’t work in 12 months. Even though I’ve spent a decade doing SEO, I still feel like I’m relearning it every year. If you’re focused on a single marketing channel, you’ll have a much easier time keeping up.

- Online marketing channels are power laws. That means the majority of the profits go to a few big players — everyone else fights for scraps. If you’re not one of the winners, you won’t be making much.

If you stick with one marketing channel, you’ll get through the learning curve a lot faster. The faster you unlock your marketing channel, the sooner you’ll be making real money with your online store.

OK, step one is done. It was a long one, but it’s important that you spend time on it — it’s the very foundation of every other choice you’ll make in the process of setting up your online store.

Step 2: Find the Right Product Niche for Your Online Store

After choosing your marketing strategy, picking your product niche is the most important decision that you’ll make. Slow down and take your time to do some genuine research here.

A huge mistake that I’ve made in the past was jumping into hobby categories. Yes, being personally interested in the category really helps with building the business. But it’s also a common trap for picking a category that won’t support a thriving business. If there isn’t much demand in my niche, it doesn’t matter how great of a job I do, I’m doomed to fail from the beginning.

There are a few things I look for in a good product category for an online store.

First, avoid picking a category that’s too unique.

A common best practice in marketing is to differentiate yourself. And this is powerful advice — it’s a huge advantage when you have it.

It’s also tricky to find a genuine way to differentiate yourself that the market is willing to pay for. There are countless ways to differentiate any given product, but only 1–2 actually matter.

Does the top-rated toothbrush holder on Amazon need to do something wacky and unique? Not at all. It needs to be simple, easy to use, reliable, have a good price, and have a ton of reviews on Amazon. That’s it.

Instead of trying to differentiate yourself from every other product in your category, find a category with competitors that aren’t dominating their marketing channel. Are the Amazon reviews low for all the top products? Are the SEO results low quality? Are there no companies putting serious ad dollars behind a product? If the answer is yes, there’s an opportunity for you to out-compete them with your marketing.

A moderate price is also key.

Avoiding product categories with a low price makes a lot of sense. After all, if you only earn $1 in profit for each sale, you’ll have to sell 100,000 products every year to support yourself. After taxes and overhead, that’ll give you about $50–60K per year to live on.

Selling 100,000 of anything is a lot of work. No easy task.

Now let’s assume that you’re selling something for $80 and making $40 in profit on each sale. To make $100,000 per year, you’ll only need to sell 2,500 items. That’s much more manageable.

However, you also want to avoid selling something with a price that’s too high. As price goes up, so does buying behavior. Prospects demand more proof. They may even demand a completely different buying process. How many people buy cars without test driving them at a dealership? Most don’t. They want to see the car and talk to a real person before making a purchase that big. Cars require a lot of extra work and sales skill to sell effectively because of their higher price point.

We recommend finding a product that you can sell between $50 and $100 dollars. It’s high enough that sales will add up quickly for you. It’s also low enough that the buying process will be straightforward.

Lastly, make sure there’s demand.

You can usually tell if there’s demand by doing some category research on your marketing channel. For SEO, Google Ads (formerly AdWords) has a Keyword Planner that tells you how many times something is searched in Google every month. If the keyword for your product gets less than 1,000 searches per month, it’s probably too small to build a business on.

Same thing with Amazon, if you have trouble finding products in your category with more than 100 reviews, it’s probably too small.

These days, I’d much rather pick a category that I have zero experience in but has genuine demand. That’s much better than realizing that a passion category of mine has zero demand later on.

Step 3: Pick a Name for Your Brand

The bad news: everyone hates this step.

Trying to find a good name that’s not already taken gets really annoying. The websites are taken, the best names have been trademarked, and you’ll feel like you’re hitting dead-end after dead-end.

Good names are tricky to find.

Whenever I look for a new name, I feel a temptation to cut corners. After several full days of brainstorming names and hitting dead-ends, all I want to do is pick a less-than-ideal name just so I can move on to the next step.

I have to tell myself that it’s worth the effort to keep looking. It’ll pay off if I keep going and it always does.

Here’s the naming checklist I use:

- Easy to spell. I never want any friction when people are trying to find my site.

- 3 words or fewer. I like to keep it at short as possible so it’s easier to remember. 1 or 2 words is ideal, 3 is still good.

- Pass the Bar Test. I should be able to say the name in a noisy bar without repeating it. That’s a great sign that it’s easy to understand. This is huge for word-of-mouth marketing later.

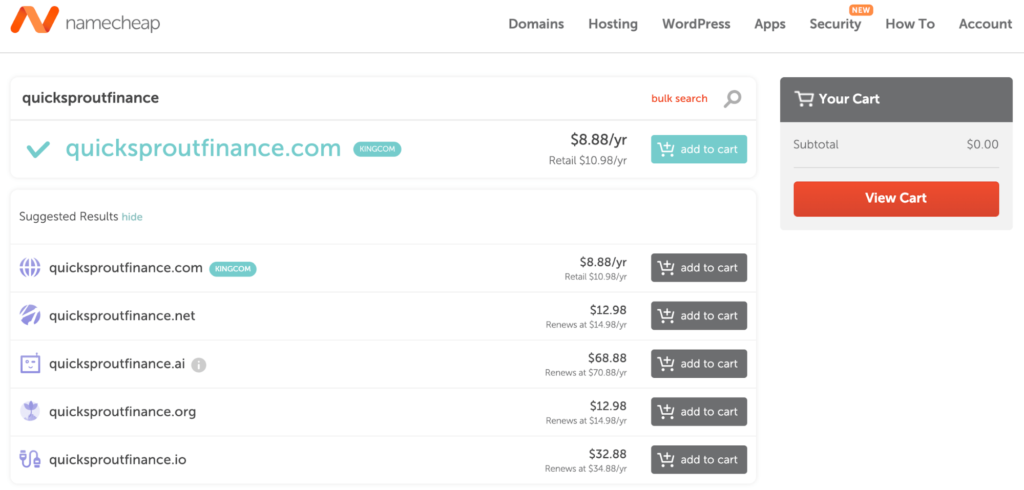

- Can get the .com domain. Every online story needs a .com. It’s become too much of a standard. Some folks use weird domains like company.online or company.io. In my opinion, this causes problems later because whoever owns company.com will know how valuable it is once you try to buy it. I either buy the domain early or find one that’s instantly available.

- Relevant to your category. Make sure the name relates to your product category in some way.

- No trademark conflicts. Any corporate law firm can do a quick check for you on this. Since legal time is expensive, find 3–5 name options that check all the above items. Then have an attorney check for the trademarks all at the same time. It’s rare to not have at least one of them work.

We have an in-depth guide on how to pick and buy a domain name here.

Once you have your name picked, grab the domain using your domain registrar. Or if you’re buying the domain from someone, get it transferred into the domain registrar that you want to use for the long term.

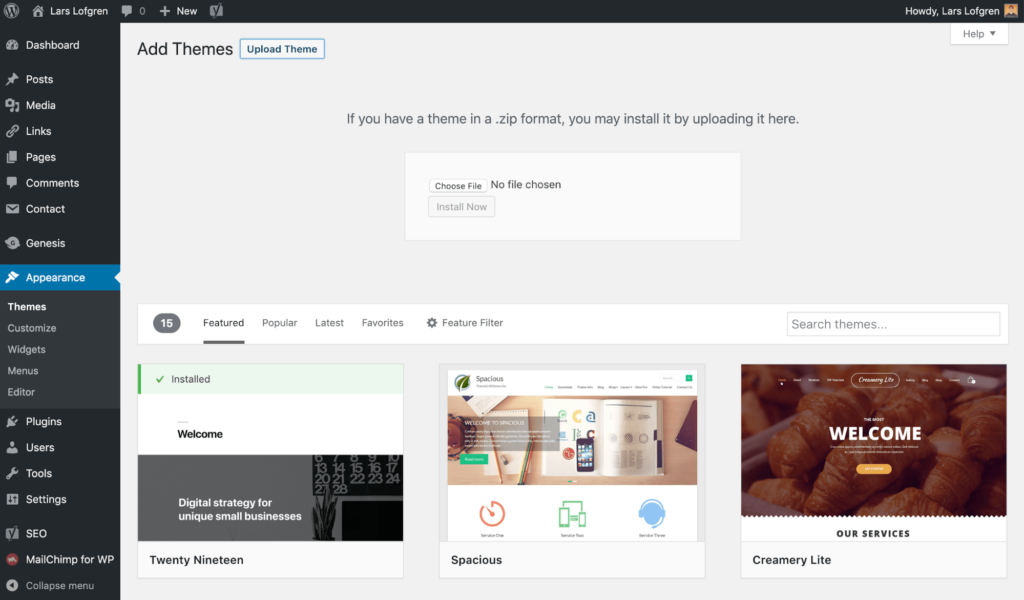

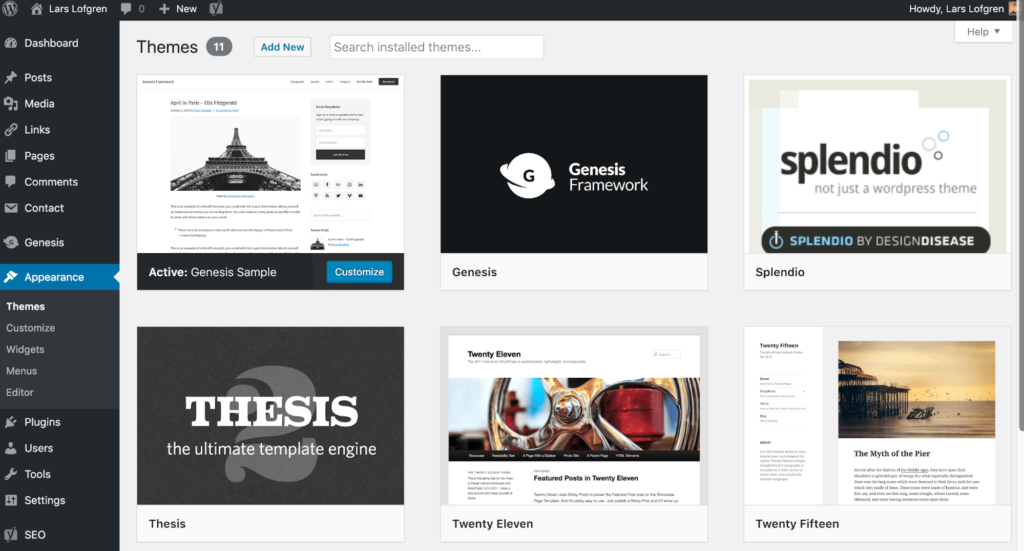

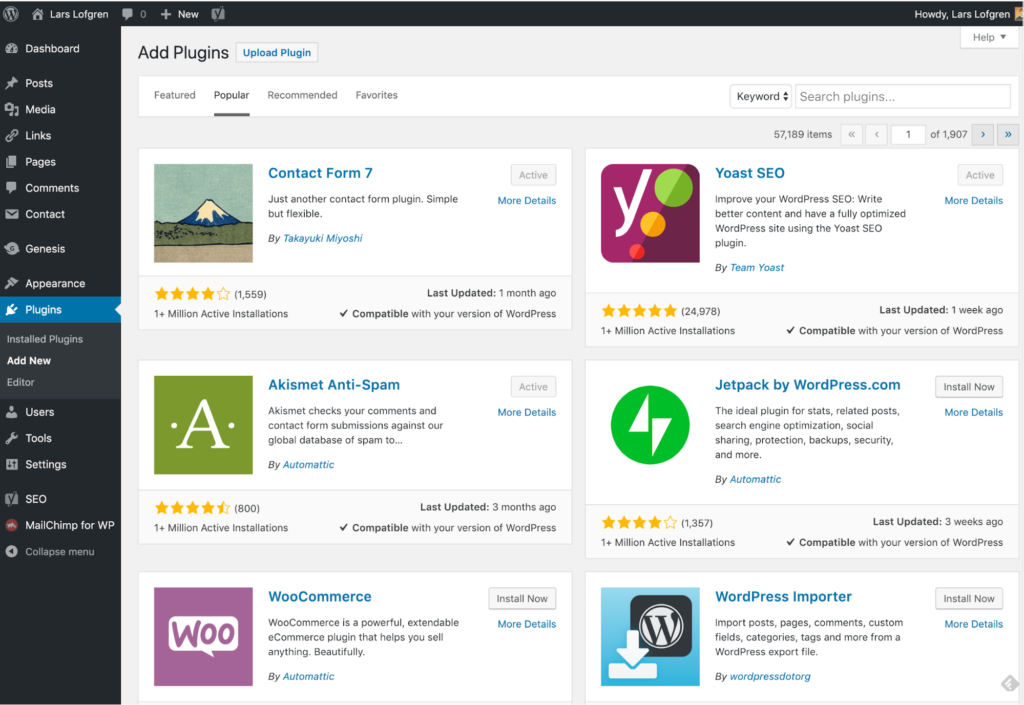

Step 4: Open Your Online Store

If you’re pursuing an SEO or paid marketing strategy, this is a super important step. The quality of your site has a huge impact on how much of your traffic will turn into buyers.

First, we strongly recommend Shopify for building your site.

There are other tools out there like Magento and Bigcommerce — none of them compare to Shopify. It’s super easy to use, has all the features that you’d ever want, and has a very reasonable price.

The one exception to this is if you’ve already built out a blog with a large audience and want to add a small online store to it in order to sell a few items. In this case, adding WooCommerce to your WordPress is a good option.

Otherwise, always go with Shopify.

We’ve put together a detailed guide on creating an ecommerce website here.

And if you’ve picked one of the platforms like Amazon, treat your company and product pages with great care. Make the copy as compelling as possible. Use every feature that they give you. Get the highest quality photos that you can. Do everything. Really make your pages stand out.

Step 5: Do a 60-day Marketing Burst

All of our stores start from scratch.

When we’re just getting started, any bit of momentum goes a long way.

That first review, that first page that ranks in Google, that first purchase using a paid ad — it’s life changing.

At this stage of the process, I never worry about systems, scalability, or trying to do things in an efficient way. I’m looking for momentum any way that I can get it, no matter how much outreach or personal work I have to do.

The goal at this stage is to put in a huge burst of personal effort and get some momentum. Even if you have to do things that you know aren’t sustainable over the long term.

Here are a few examples:

- I might tap my personal network to see if anyone is willing to do an interview with me and publish it on their own site. This will help me get a few initial links to my site.

- I could ask personal friends and relatives to leave the first couple Amazon reviews.

- I’d try spending some of my own cash on paid ads to test if the offer produces revenue at all.

I’m looking for any marketing idea that involves my time but also allows me to quickly get my first few wins.

At this stage, do some research on your marketing channel and come up with a list of 50 ideas that you could personally do yourself. Then prioritize them and plan a 60-day Marketing Burst. Ship as many of those ideas that you can within those 60 days. Work long hours, drink too much coffee, and really push yourself during that period.

By the end of the 60-day Marketing Burst, some of your marketing ideas will have worked and you’ll have your first couple sales. You’ll also have a small but steady stream of sales coming in because you’ve focused on a single marketing channel. That steady stream is enough to start building your marketing flywheel on.

Step 6: Build Your Marketing Flywheel

Once you have some initial momentum, it’s time to start building the marketing machine that will grow your business around the clock without you having to personally accomplish every task.

In the early days on Amazon, you’ll need to personally ask for a lot of your first product reviews. But that’s not sustainable.

Instead, look for marketing tactics that help create Amazon reviews for you without you asking for them.

Here’s an example.

A popular tactic on Amazon is to ask customers to leave a review. Some will even promise a discount code on the next purchase if a review is published.

You can automate that tactic. Have an assistant send the same templated email to every new customer, asking for a review and promising a discount code on their next order. All the platforms allow you to message customers personally through the platform. So while you can’t email blast all your customers at once, you can have an assistant send messages out one-by-one every week on your behalf. That’s a repeatable flywheel that doesn’t take up your time.

A quick side note on this review tactic: Before you try something like this, make sure to check the guidelines and policies of the platform you’re on. There are always rules about these sorts of things and every platform is slightly different. Be careful to not push things too far, putting your store in danger of getting removed entirely.

Look for as many of these repeatable marketing flywheels as you can.

Instead of creating content yourself, can you pay someone for content? If you did the keyword research, made a list of requirements that you want on each piece of content, and hired someone else to write the post itself, you could create a lot more content to help you win with an SEO marketing strategy. That’s a flywheel.

Instead of optimizing your paid ads yourself, can you delegate that? If your conversion rates are consistently improving and your cost to acquire a customer is going down, that lets you buy more customers with the same amount of capital. That accelerates your business without your personal effort. Another flywheel.

Focus on your core marketing channel and then build a marketing flywheel that will keep your online store growing without any effort from you. This is the key to opening an online store, generating sales quickly, and accelerating its growth.

Source Quick Sprout https://ift.tt/2HxYQbI

21 Ways I Use Frugal Tactics in My Morning Routine

This morning, when I woke up and went through my usual morning routine that revolves around getting myself awake, getting the kids ready for school, and getting myself ready for working, I noticed that there were little frugal tweaks everywhere. I kept noticing all of these little changes I’d made over the last several years that shave a few cents or a quarter or a dollar off of the activities of my morning routine. These little tweaks don’t really change the nature of the thing I’m doing, but they do mean that my normal daily routine is less expensive than it once was.

I thought it might be interesting to walk step by step through a typical morning of mine, starting at the point that I wake up and ending at the point when I start my actual workday, and point out all of the little frugal tweaks along the way.

Before I get started, it’s worth noting that I work from home, which means that I don’t have the cost of a commute nor the cost of a professional wardrobe. Most days, I work in inexpensive, comfortable clothes – a well-worn soft t-shirt and worn blue jeans, usually. Thus, I won’t be talking about ways to save money on a commute, but I’m instead focusing on the other elements of the morning routine that most people who work and have kids have to face each workday/schoolday. I asked Sarah about strategies that she uses to save on her commute and I’m sharing some of those at the end of this article.

Let’s dig in.

Pretty much the first thing I do when I get out of bed is grab a refillable bottle of water out of the fridge and start drinking it. Rather than just buying jumbo packs of bottled water at a store, I just have a handful of water bottles that are filled and kept in the fridge for anyone to grab. I’ll usually refill this bottle a few times during the day, meaning that my beverage costs are really low.

I then usually spend some time reviewing my day and calming my mind. I usually start with reviewing my calendar in Google Calendar, which is free. I use it to track every time-oriented event in my life. If it’s something where I or someone in my immediate family needs to be somewhere at a certain time, it’s in this calendar, and I check it each day just to have a good mental picture of what the day is going to look like. I moved to Google Calendar a few years ago, dropping a paper planner, as I found that things that are just information storage and retrieval, not things I have to think critically about, are best stored digitally.

If I’m up early enough, I’ll do a free flexibility routine from Youtube. It lets me stretch out my body and I find it not just physically enjoyable, but mentally relaxing, too. I also like to do mindful meditation for ten or fifteen minutes while listening to white noise. Again, this is something to calm and focus my mind and it’s free, but it’s worth noting that unlike the stretching, it’s not something that has immediate benefits; it tends to build slowly over time if you repeat it each day. I usually spend some time writing in a journal, usually in the form of just dumping out what’s in my head so I can focus on the day.

At this point, depending on what is on the meal plan for kids for breakfast and how early it is, I either start breakfast prep or settle in to read a book for thirty minutes.

If I’m reading a book, I’m typically reading something I checked out from the library for free; currently, that’s Dodge by Neal Stephenson.. I’ll sit in a comfortable chair, finish off my water, and go through a bunch of pages in the book.

If I’m doing breakfast prep, I could be making any number of things. Here are a few examples.

One common cheap breakfast is oatmeal. I put some water on to boil, then grab a container of quick oats from the cupboard and another container that has a mix of cinnamon and brown sugar in it (6 parts brown sugar to 1 part cinnamon). I put a half-cup of the oats in each bowl, then a tablespoon of our brown sugar mix, and then I mix it. I then chop up some fruit into each bowl, whatever’s on hand – a banana, an apple, whatever. I then pour about half a cup of the water (boiling or near boiling) into each bowl, stir it, and microwave it for another 30 seconds and serve. Easy and dirt cheap.

Another common quick breakfast is scrambled eggs. I’ll just crack ten eggs into a bowl, add some salt and pepper, and thoroughly whisk it, then put just a bit of butter in a skillet over medium heat and when the butter melts and coats the bottom, I pour in the eggs, keeping them scrambled as they cook, and then serving equal amounts to everyone (two eggs’ worth for everyone if Sarah is still home, two and a half for everyone if she’s already gone).

If I think of it the night before, I’ll often make “Swiss breakfast.” Basically, I take three cups and layer rolled oats and fruit in those cups with a bit of honey in each layer. I’ll put in perhaps 1/8th cup rolled oats, top it with a tiny bit of honey, put in 1/8 cup fruit, put in a few drops of honey, and repeat twice more. Then, I’ll fill the cup up with milk until it’s just above the top of the top layer of fruit and put it in the fridge overnight, covered. In the morning, I just pull it out and serve it with a spoon. This is about the same cost as our morning oatmeal, but has a much different taste and feel.

I also make yogurt-fruit smoothies, fruit salads, and other things for breakfast. On extremely rushed mornings, we do have a box of cereal on hand because there’s almost nothing faster.

The point is to keep breakfast simple and cheap but also healthy and nutritious.

Anyway, right as the kids are getting up, I want to get a brief digest of the day’s news, which is about the only time I really pay any attention to current events. Rather than turning on cable news to get my morning news, I just give a cursory glance at Allsides to get a brief summary of the news (free) and then turn on NPR (free) on the radio in the kitchen. Those are far cheaper options than having a cable subscription.

After breakfast, I’m mostly putting out fires for ten or fifteen minutes as the kids get ready for school. There’s always something to find or some paper to fill out or a shoe to recover from a dog’s hiding place or something like that, so I leave at least a ten minute gap, if not longer, for those things.

Once the kids leave for the bus, I usually take a shower. I use pump dispensers for liquid soap and shampoo so that I’m not using more than I need, thus avoiding waste, and I try to take a quick shower to avoid using up all the hot water and so I can get to work quickly. (I use these.) The soap and shampoo I use is usually whatever’s on sale at the store; right now, I’m using some jumbo bar soap that cost $1 each at a big sale where I think the store was liquidating stock (it’s Duke Cannon soap, and the bars are enormous) and I’m using Suave for Men shampoo/conditioner combo that had a nice sale on the jumbo-sized bottle. The same is true for other toiletries – I use generic heads for my toothbrush, use free toothpaste from the dentist or whatever’s on sale at the store, and so on. As mentioned earlier, I dress for work in a comfortable, well worn t-shirt and jeans.

At this point, I usually start a load of dishes and a load of laundry, if needed.

If I’m doing laundry, I usually run a load using homemade laundry soap (I just mix a cup of borax, a cup of washing soda, and a cup of soap flakes in a container and leave a measuring tablespoon in there – one tablespoon of the mix is good for any load) and using cold water for both the wash and the rinse setting, which cuts down on the hot water cost. When I dry my clothes, I usually just use the permanent press setting by default; the clothes don’t come out warm, but a lot less energy is used.

When I’m running a load of dishes, I usually either use whatever kind of dishwashing soap is on sale or, if I’ve had some spare time lately, my own “dishwasher packets” made of salt, washing soda, baking soda, powdered lemonade, water, and a bit of liquid dish soap. (I’m currently using this recipe.) In either case, it’s way cheaper than just grabbing whatever dishwashing detergent you first see at the store.

After that, and after doing a few more minor household tasks, I get ready for the work day.

The first thing I do is make a big cup of green tea. I am often gifted tea, so I’ll usually use that, or I’ll use some bulk tea I bought. I usually make several cups at once and keep it in a large cup that keeps it warm for several hours. I boil a quart of water and use an appropriate amount of tea leaves or bags to get it just right, then stir in a bit of honey.

At the same time, I pour myself some cold brew coffee from the fridge. Cold brew is about the cheapest way to make coffee at home that I’ve found and it turns out delicious. I have a cold brew coffee maker very similar to this one in which I just put some grounds in a mesh filter, put that filter in 32 ounces of water, and stick it in the fridge. After 24 hours, it’s amazing; I’ll just pour all 32 ounces in another giant cup and take it with me, starting another batch immediately.

At this point, when I have my coffee and tea ready to go, I’m ready to start my day. I turn off most common distractions – turn off notifications on my phone, close the door to the area of the house where I work, turn on a piece of software that blocks some distracting websites on my computer – and then set myself up to focus by turning on some focusing audio, like the white noise mentioned earlier. Then, I’m good to go.

At the end of the day, living frugally isn’t about radically changing your lifestyle. Sure, you can make some big changes to save money, and that’s often a good idea to do so, but the day to day routine of frugal life really is about finding small efficiencies that don’t reduce the quality of living but do save you money, time, and energy.

So, what about Sarah? Sarah works outside the home as a teacher and has a daily commute. I asked her about some of the things she does during her commute to save money and jotted down many of the things she shared with me.

First of all, she spent a lot of time optimizing her route to minimize driving distance. Shaving just a couple of miles off of her commute means less frequent fill-ups, less frequent maintenance, and a longer lifespan for her car. Each time she’s changed positions and we’ve moved, she’s studied the optimum commute using tools like Google Maps, found some candidates, and tried them out. From where we currently live, Google Maps actually does point her to the best route, but at our previous residence, there was another route that she discovered that shaved three miles off of her commute each way, and that really added up.

She likes to drink some coffee on her way to work but her mornings are busy, so she has a very tight routine for making her own coffee at home so she’s not buying it on her way to work. She prefers hot coffee and has a drip coffee maker that she’s had for many years, and she basically has this down to an exact science so that she can leave the house with a full coffee mug of coffee made at home, just as she likes it. This is far less expensive than stopping for coffee along the route each day.

She has carpooled in the past with another teacher that lived in our area. They would alternate driving to school and had a set time when they would leave each day. This cut her commute time in half. Unfortunately, the other teacher retired, so they’re no longer able to carpool, but she actively looks for people to carpool with each year out of the new hires at her school.

She drives a late 2000s Toyota Prius and intends to drive it until it no longer runs well. It currently has near 200,000 miles on it. It gets approximately 45 miles per gallon, which means that, since she drives it about 15,000 miles a year for commuting, it saves her about 267 gallons of gas per year, which adds up to about $700 in savings just from gas alone. She’s interested in replacing it with a low cost fully electric car (think Nissan Leaf) after doing the math on the costs, provided that the market develops a little more before she rotates car.

She typically fuels up at a warehouse club. The only warehouse club convenient for us is Sam’s Club, so she uses that for fuel most of the time. The only exception to this is when she has accumulated points in the customer rewards program at a local grocer, which are actually used at a gas station chain in the area. We usually use this to fill up our van, though, which means one fill-up of our big vehicle at a cheap rate.

She knows how to change a flat on her own. If she ever gets a flat, she can just get it off the road, change it herself, and get to work without calling an expensive service.

The simple truth is this: no matter what your morning routine contains, there are likely ways to shave off a bit of that expense without changing the nature or quality of what you’re doing. A move that saves $0.10 per day on your workday morning routine, repeated 5 times a week, 50 weeks a year, adds up to $25 saved. Make ten of those little tiny changes and that’s $250. Make some bigger ones and you’re quickly looking at four figures in savings per year.

There are really two ways to see the power of frugality. One is the big changes – moving to a cheaper house, eliminating a service, renegotiating a bill, and so on. The other is finding a cheaper way to do something that you do all the time without losing the quality. If you do something every day and can find a way to do it a little cheaper, that savings is going to add up enormously over time. It won’t have the big splash of the singular move, but what it will do is give you breathing room all throughout your financial life and making it easier to take a step like contributing more to retirement or starting a 529 for your kid or even making a challenging career switch.

Good luck!

The post 21 Ways I Use Frugal Tactics in My Morning Routine appeared first on The Simple Dollar.

Source The Simple Dollar https://ift.tt/2ZAN9qI

How Stella & Dot Helped This Mom’s Corporate Career

Kelly Wenzel is a Texas-based mom of two. Her daytime duties consist of working from home full-time as a Director of Professional Services at Cornerstone. But on the side, she works as an independent Stylist for the direct sales company Stella & Dot. Find out how her side hustle has helped her become more confident […]

The post How Stella & Dot Helped This Mom’s Corporate Career appeared first on The Work at Home Woman.

Source The Work at Home Woman https://ift.tt/2NAYTqS

الأربعاء، 28 أغسطس 2019

How to Start a Blog in 12 Easy Steps

I started my first blog to avoid getting a job.

I’m completely serious.

I was coming to the end of my undergraduate degree in international affairs and the thought of getting a job at the state department or in journalism sounded like a horrible idea.

So I learned how to start a blog and built one on international affairs with the hopes of eventually monetizing it and supporting myself.

That didn’t really work out as planned. Hah.

But it did lead to a career in online marketing and now I do work on blogs to avoid having a real job.

Whether you’re trying to avoid a job entirely or trying to quit your current job, starting a blog is a reliable path to supporting yourself and your family. It takes a lot of work and some time but it is a well-traveled path at this point. It’s not nearly as crazy as it was when I started.

I’m going to walk you through the 12 steps to start a blog, which are particularly useful for beginners who have never done this before.

Now, let’s dive into the step-by-step process.

Step 1: Pick a category to focus your blog on

The most important decision to make when starting a blog is which category you’re going to write about.

Why pick a category at all? Why not write about anything that interests you?

When it comes to building an audience, increasing traffic, and monetizing your blog, you’ll get a lot further a lot faster if you stick to a specific category.

Think of it like this: Let’s say you stumble on a blog of mine. You find an amazing post about how to turn email subscribers into fully passive income. You love it and subscribe to my email list. Then I send you an email about how to organize your closet. How would you react? Maybe you’d love it if you also really love organization. But most people would be turned off. They want more content about email lists and making passive income.

Jumping categories can be really jarring for any audience. Google also greatly prefers blogs that are focused on a single topic, which will help you with SEO a lot.

Whatever you do, pick a category and stick to it. If you want to try another category, start a new blog.

Here are a few popular categories that always do well:

- Personal finance

- Fitness

- Online business

- Investing

- Productivity

- Real estate

- Careers

- Test prep

- Freelancing

My recommendation is to pick one of the categories above and niche it down one more time. Personal finance for people making over $100,000 per year is a good example. Or fitness for people over 60 is another.

Categories get tough when they’re super consumer focused and have extremely large audiences. Celebrity blogs are a great example. There’s tons of competition in this space but also very limited money compared to other blogging categories. It’s a brutal combo. All the work without any of the payoff. Recipe blogs are another example of a brutal category. World-class competition and very few ways to monetize. Try to avoid categories like these.

One of my favorite category types is B2B. This includes categories like how to do marketing, build products, HR, customer service, manage a team, or improve your sales skills. The volume in these categories is always lower than the popular categories that I listed above. But the quality of traffic is always incredible. Businesses are always willing to spend more than consumers to solve their problems; they have access to a lot more cash. The downside is that you need to have experience and skills in these areas before being able to blog about them. They’re not nearly as easy to break into.

Hobbies can also do okay, but they’re typically more difficult to monetize. That said, I’ve come across entrepreneurs who have built six and even seven figure businesses in hobby spaces like horse riding or learning the guitar. It’s doable. It’s just more difficult because people aren’t willing to spend as much on their hobbies.

Step 2: Find a domain for your blog

Before we jump into how to find and buy the right domain, I should clarify one assumption I’m making in this post: I’m assuming you’re starting your own blog on a blog platform that you’ll own and run — your own website.

That’s not the only way to start a blog, you can use a blog site like Medium, LinkedIn, Instagram, or Facebook. If you want to make money, you need to build your own site, which I’ll cover in this post. If you’re thinking about launching your blog on a blog site, you should stop here, and go check out The Best Blogging Platforms and Blog Sites of 2019. That post explains the pros and cons of each platform. This step — choosing where to start your blog — is the “one thing gurus always get wrong about blogging” according to Gary Vaynerchuk. I’m not calling myself a guru, but I can proudly say I’m getting this right.

OK, so everyone still reading is going to set up their own blog site — let’s start with a brief discussion of how website technology works. There are a few things you’ll need to sign up for as you set up your blog, so it’s good to see how they all connect before we get too deep.

- First, there’s the domain. This is the URL of the website. Think of it as the address for your business. You’ll need to buy your domain.

- Second, the domain registrar. This is the company that you’ll use to buy your domain and hold it for you. They don’t host your site or anything — they just store your domain and point web traffic to your site which will be on your web host.

- Third, the web host. This is the company that hosts your site. Your site will be on its servers.

- Fourth, the tool to build your site. Very few sites are built by hand using raw HTML and CSS these days. Almost all of them are built using a tool. The tool handles a lot of heavy lifting and makes building a site substantially easier, especially if you have no idea how to code. This is how you’ll configure your site and publish your blog posts. For blogging, these tools are called content management systems (CMS) and the only real option is WordPress. Once you’ve installed WordPress on your host, you’ll be able to start building your site.

To recap, you’ll buy a domain using a domain registrar, install WordPress on your host, then start building your site. I’ll walk you through how to do each of these things step by step.

Now, how to buy a domain for your blog.

In order to buy a domain, you’ll have to find one first. This domain should be somewhat related to the category you picked and should also be available for purchase.

I highly recommend you keep searching until you find a domain that’s available. While it is possible to buy a domain from someone who already has it, that’s an advanced option and can get expensive fast.

Low quality domains will usually go for a few thousand dollars. Highly quality domains that are two words can easily go for $10,000 to $50,000. I’ve even been in discussions to purchase domains for over $100,000 and the really hot ones can break seven figures. Not to mention all the hassle that comes from finding the person who owns the domain, negotiating with them, and transferring the domain if you can get an agreement.

Your best bet is to keep going until you find a domain that you like and can purchase directly from a domain registrar for about $10.

We go into lots of detail on which domain registrar to use here. The short answer: use Namecheap. It’s awesome, it’s the best, it’s what I personally use.