Can you really invest for free? Actually, you can, using the Robinhood Investment app. And not only can you invest for free, but you can do it directly from either your mobile device or your desktop.

They’ve also expanded beyond stocks, and now offer options trading – also free.

Why would you pay to buy stocks or trade options when you can do both free with Robinhood?

What is Robinhood?

Robinhood was actually developed by two Stanford University graduates who started out selling trading software to hedge funds.

They came to realize that the big brokerage firms pay something close to nothing to trade stocks. At the same time, they charged investors a fee for every trade.

With that realization, they built Robinhood, as a company that leverages technology. It enables everyone to invest without the fees charged by traditional investment brokerages.

Their mission is no less than to democratize access to the American financial system. To do that, they developed an investing platform enabling you to buy various investment securities commission-free.

How the Robinhood Investment App Works

You can buy and sell securities directly through the Robinhood investment app. The app offers the ability to buy and sell more than 5,000 stocks and exchange traded funds (ETFs). You can also buy and sell options.

The app allows you to get information on individual securities. This information appears on the “Details” page for each security. There you can check the earnings per share of a company. You’ll also have a description of your position in each investment.

This will include the number of shares you own, the value of those shares, the average cost paid for them, the percentage of your portfolio represented by that security, as well as the daily and total gains and losses from that investment.

You’ll also get basic information, such as a security’s trading statistics for the day, as well as dividend yield, price-earnings ratio, and 52-week high and low prices.

But perhaps the most interesting option, and what sets Robinhood apart from other investment platforms, is that you can also trade cryptocurrencies. This is done through Robinhood Crypto, and is available in 27 states (they’re working to add more states).

Current cryptocurrencies available include Bitcoin (BTC), Bitcoin Cash (BCH), Dogecoin (DOGE), Ethereum (ETH), Ethereum Classic (ETC), and Litecoin (LTC).

No day trading allowed. This restriction is hardly a surprise since the absence of trading commissions would seem to invite the practice.

There are specific trading patterns that can get flagged as day trades. For example, if you execute four trades in five days, your account will be flagged as pattern day trading for 90 days. If your account value is less than $25,000, you won’t be able to trade until the value closes above $25,000, or 90 days passes

Robinhood Investment App Features

Robinhood Investment Mobile App

The app is available on Google Play for all Android devices running 5.0 Lollipop and newer and available on iOS devices (10.0 or later) on the App Store. Compatible with iPhone, iPad, iPod touch and Apple Watch.

Robinhood Fees

Robinhood has no fees. That’s no fees, as in no trading commissions and no monthly account fees. The platform makes money through Robinhood Gold, which is its margin trading service that starts at $6 per month.

They also receive interest income from customer cash and stocks, in much the same way a bank collects interest on its deposits as well as receiving rebates from executing brokers.

Account withdrawals

Just as you can transfer money into your account from a linked bank account, you can also transfer money from Robinhood into your bank account. You can withdraw up to $50,000 per business day from your account.

However, any funds withdrawn must come from uninvested funds, and any deposits need to stay in your account for a minimum of five trading days before they will be eligible for withdrawal.

Robinhood Account Security

Robinhood Financial is an SEC-registered broker-dealer. That means your account is covered by SIPC, for up to $500,000 in securities and cash, including up to $250,000 in cash.

The platform also provides a number of high-level measures and industry best practices to protect your account.

For example, sensitive information, like your Social Security number, is encrypted before being stored.

They also don’t store your online banking credentials. And both the mobile and web applications securely communicate with their servers using the Transport Layer Security (TLS) protocol.

Refer Friends, and Get Free Stock

If you refer a friend to the app, both you and the friend will get a free stock once your friend’s application is approved. By referring multiple friends, you can earn up to $500 in free stocks.

The stocks are chosen randomly from Robinhood’s inventory of settled shares. They are generally selected from the most popular companies on the Robinhood platform, based on the total value and the price of each share. The value of a share can be anywhere between $2.50 and $200.

Start investing with Robinhood today>>

How to Trade on the Robinhood Investment App

The platform enables you to trade stocks, exchange traded funds, cryptocurrencies, and options. You can also trade American Depositary Receipts (ADRs) for more than 250 globally listed companies.

Trading is done through your Robinhood Cash (non-margin) account.

Stocks and ETFs

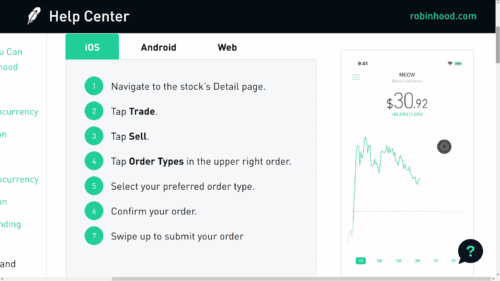

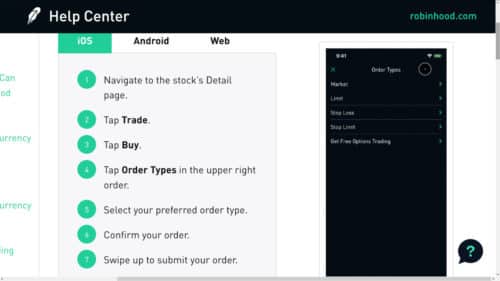

You can invest in more than 5,000 different stocks and ETFs on the platform. Trades can be executed from your mobile device, by navigating the stock’s Detail page, then tapping Trade, Buy, and Order Type. You then confirm your order and swipe up to submit it.

Selling stocks or ETFs works the same way, except instead of tapping Buy, you tap Sell from the stock’s Detail page.

Options

Options trades are even easier. To buy, you go from the stock’s Detail page, tap Trade, then Trade Options, then Buy, and you’re done. Selling works the same way, except rather than tapping Buy, you tap Sell.

When you trade options on Robinhood, there are no base fees, no exercise and assignment fees, and no per contract commission. However, they do require that you have stock trading experience before you can begin trading options.

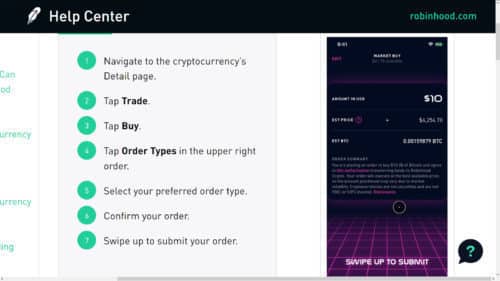

Cryptocurrencies

Trading cryptocurrencies works the same as other securities. From the cryptocurrency’s detail page, you tap Trade, then Buy, then Order Types. You then select your preferred order type, confirm your order, then swipe up to submit the order.

Selling works the same way, except instead of tapping Buy, you tap Sell.

Robinhood Gold

This is Robinhood’s premium margin account. It offers commission-free trades, gold buying power, and larger instant deposits (larger than $1,000). The Gold account also allows you to double your buying power. For example, $10,000 in cash gets you $20,000 in buying power.

Since Robinhood Gold is a premium service, there are fees attached to it.

There are still no commissions for this account type. But there is a monthly fee of $6.

And if you borrow over $50,000, interest is charged at a rate of 5% APR. And as an added bonus, your first consecutive 30 days are fee-free and interest-free.

How to Sign Up with the Robinhood Investment App

To sign up for Robinhood, you must meet the following requirements:

- Be at least 18 or older.

- Have a valid Social Security number – they will not accept a taxpayer identification number.

- Have a legal US residential address within the 50 states or Puerto Rico. They may make exceptions for active US military personnel stationed abroad.

- Be a US citizen, US permanent resident, or have a valid US visa.

To open an account, you complete an application in the Robinhood app. You’ll receive an email within one trading day, either confirming your application’s been approved or requesting additional information. Typical documentation requested will be evidence verifying your identity.

You’ll be able to upload the documents securely by taking a photo of the documents using your mobile device. The documents can also be uploaded online to Robinhood’s secure file portal.

Once your application account has been approved, your account will be opened within five to seven business days.

Funding your RobinHood account. You can fund your account by linking it to a bank account and making electronic transfers. You can transfer up to $50,000 per business day. Deposits up to $1,000 are instant, but larger deposits will take four or five business days to complete.

Robinhood Investment App Pros and Cons

Pros

- No fee trades.

- You can trade stocks, ETFs, options and cryptocurrencies.

- There’s no minimum investment required, opening the platform to investors at all levels.

- After hours trading.

Cons

- No availability of retirement accounts, particularly IRAs.

- Limited investment options. There’s no ability to trade individual bonds, mutual funds, real estate investment trusts, or many of the other investment classes available with traditional brokerage services.

- Certain securities are unavailable for trading. Those include foreign stocks, select over-the-counter equities, preferred stocks, and securities purchased on foreign exchanges.

- The platform generally gets poor ratings on customer service, which likely is a soft cost paid in exchange for free trading.

- Robinhood accounts don’t permit day trading, if you might plan to take advantage of no commissions for that practice.

Should You Sign Up for the Robinhood Investment App?

Robinhood isn’t an all-purpose investment platform. For example, you won’t be able to purchase and hold mutual funds, fixed income securities, or foreign securities. But it is an excellent platform to purchase stocks, ETFs, and options using commission-free trades.

The platform may be of particular interest to anyone who wants to invest in cryptocurrencies. You can trade in six popular cryptocurrencies, including Bitcoin and Ethereum.

Robinhood may best be used as an investment platform for new investors, who are looking to begin investing with very little money and don’t want to pay trading fees. More experienced investors may use the platform for its commission-free trades, while maintaining assets not offered by Robinhood on a different investment platform.

Of course, as mentioned in this review, you won’t be able to use Robinhood as a day trading account, which might be a natural assumption given that there are no trading commissions.

Also, it’s not one of the more sophisticated trading platforms in the industry. It lacks many of the tools and features of major investment brokerages. All that aside, there’s nothing quite like commission-free trade. That’s what Robinhood does best, and along with cryptocurrencies, it’s a compelling reason use the app.

If you’d like more information, or you’d like to sign up for the app, visit Robinhood today.

The post Robinhood Investment App Review – Do They Really Have Free Trading? appeared first on Good Financial Cents®.

Source Good Financial Cents® http://bit.ly/2UoFhXf

ليست هناك تعليقات:

إرسال تعليق